As an employer, you need to know all your rights and responsibilities towards your workers, including whether you need to offer health insurance to them or not. With employee expectations for health benefits going higher and higher, employers face many issues.

The Affordable Care Act defines specific guidelines for different types of businesses that simply must provide health insurance. However, there are also businesses that don’t need to do it.

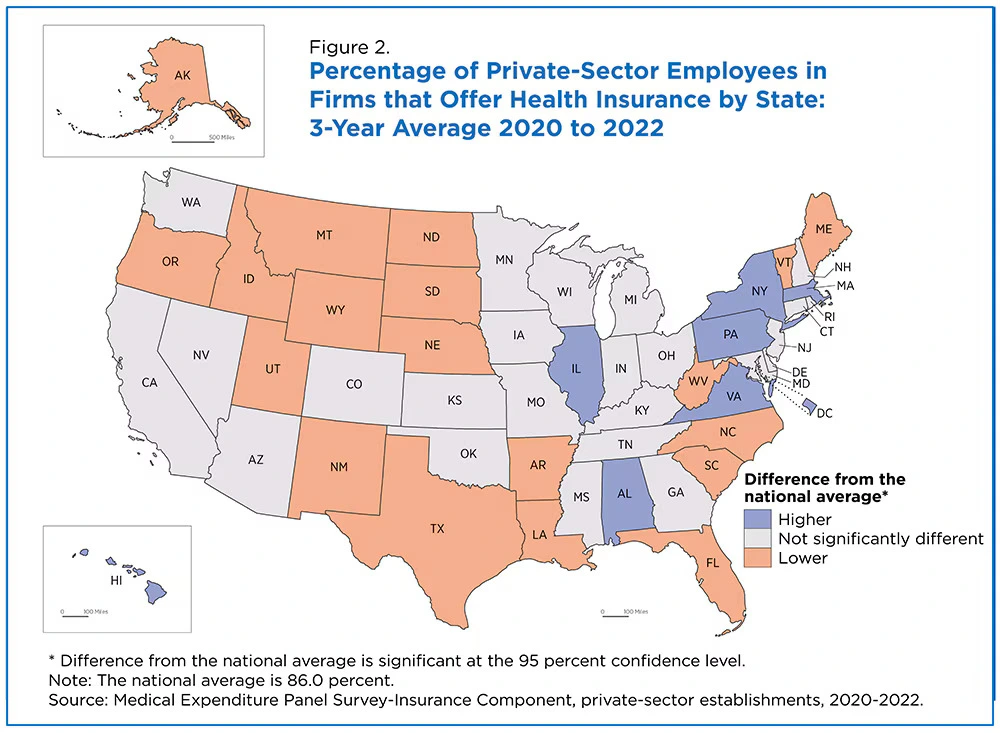

According to the US Census Bureau, 86% of people in the private sector work for an employer that offers health insurance.

So, do employers have to offer health insurance? We’ll tell you all about it in this blog, including the role of the ACA employer mandate, insurance requirements for different types of employees, how you can benefit from offering insurance, and much more. Let’s start.

As An Employer Do I Have to Offer Health Insurance?

According to the Affordable Care Act (ACA), employers who have 50 or more employees working full-time or an equivalent amount are required to provide health insurance coverage to 95% of their employees. If they don’t meet this requirement, the IRS will issue a penalty to the business.

However, if your business has fewer than 50 full-time employees, there is no legal mandate to provide health insurance, although there are a lot of benefits your business can gain from it in terms of better recruitment and retention.

What Does the ACA Say?

The ACA lays out specific requirements for employers regarding when and how they have to provide health insurance. Ultimately, it answers the question of “Do employers have to offer health insurance.” Let’s dig deeper and understand this law better.

ACA Basics

The ACA is a law that went into effect in March of 2010. Its main purpose was to increase health insurance coverage in the US. One of the primary components of the ACA that you should know about as an employer is the Employer Mandate.

The ACA, enacted in 2010, aimed to increase health insurance coverage across the United States. A primary component of the ACA is the Employer Mandate, which applies to businesses based on size and workforce composition.

So, what is the ACA employer mandate? Essentially, it applies to businesses based on their size and the composition of their workforce.

What is the ACA Employer Mandate?

The Employer Mandate is the component of the ACA that puts a responsibility on businesses with at least 50 full-time employees or full-time equivalents (FTEs) to offer health insurance.

In order to comply with this mandate, employers need to offer coverage to at least 95% of their full-time staff. It is a legal requirement, so if your business fails to meet it, you will be facing penalties.

So, when does the ACA Employer Mandate take effect? Essentially, you need to start offering coverage no later than on the 91st day of the employment of your workers, including weekends and holidays.

Definition of Full-Time Employee Under ACA

Do employers have to offer health insurance to full-time employees? Yes. But who is considered a full-time worker? Well, the ACA defines a full-time employee as someone who works at least 30 hours per week or 130 hours per month.

ACA Employer Mandate penalties can be significant. So, as an employer, you need to assess your workforce carefully to make sure that you comply.

ACA Employer Mandate Penalties for Non-Compliance

If you don’t comply with the Employer Mandate, there are 2 types of penalties you may face:

- “A” penalty for not offering coverage at all, which will cost you $247.50 per month or $2,970 per year (per employee)

- “B” penalty for offering coverage that doesn’t meet minimum requirements and/or is unaffordable, which will cost you $372 per month, or $4,460 per year (per employee)

As you can see, these penalties are not small, so you need to understand your eligibility and compliance to make sure that you avoid any penalties.

Types of Employees and Health Insurance Requirements

Different types of employees have different types of health insurance requirements. If you want to stay compliant with the ACA, you need to know these distinctions. So, when do employers have to offer health insurance to each type of employee? Let’s dive in.

Health Insurance for Part-Time vs. Full-Time Employees

The ACA mandate only applies to full-time employees. Do you have to offer health insurance to all employees? The ACA doesn’t pose any requirements for part-time workers.

Part–time workers are those who work less than 30 hours per week. Although there is no strict requirement, some employers still choose to offer them benefits. It helps them attract and retain a diverse workforce.

Other cases

Aside from full-time or part-time employees, there are other types of workers you, as an employer, might have. So, do you have to offer health insurance to temporary or seasonal employees?

Seasonal employees are those who work fewer than 120 days per year. Both seasonal and temporary workers who are hired for short-term projects are usually not subject to ACA requirements.

Legally, you don’t need to offer them health insurance, but you can do so for other benefits. You can also offer concierge medicine plans to some of your most valuable workers to show them your gratitude and retain top talent.

When Do Employers Have to Offer Health Insurance?

Under the employers’ duty of care, you, as the employer, are required to provide a safe workplace for your employees. Offering health insurance is a similar requirement, so when should you start offering it to your workers?

If you are nearing the 50-employee mark, you should start learning about the threshold and calculation methods for the Employee Mandate.

You should always keep track of the hours your employees work as well as how many employees you must make sure you don’t get accidental penalties.

Additionally, learning how to calculate FTEs is non-negotiable. So, remember this formula:

Add up the total hours worked by part-time employees per month and divide it by 120.

Next, you can add this number to the full-time employee count and understand the FTEs you have. Essentially, if you have 2 part-time employees working 15 hours per week, they might count as 1 full-time worker.

Do Small Businesses Have to Offer Health Insurance to Employees?

Do small employers have to offer health insurance? Small businesses that have fewer than 50 full-time employees or FTEs don’t need to offer health insurance. In other words, they are not legally required to do so.

Nevertheless, you can choose to offer health insurance to your workers anyway because it brings many other benefits like tax credits, better retention, and more.

Types of Insurance Employers Have to Offer

Now that we’ve talked about the types of businesses that need to offer health insurance to their workers, let’s also talk about the types of benefits they need to offer.

For example, do employers have to offer family health insurance or is individual coverage enough to meet ACA compliance?

Under the ACA, employers are only required to offer affordable health insurance to their employees. They are not responsible for extending this coverage to dependents, spouses, etc.

Still, some employers choose to also include family or partner coverage in order to give their valued workers a more comprehensive benefits package. For example, you can offer concierge medicine with health insuranceto make sure your workers get the best healthcare.

These packages can also include things like executive physicals and dental coverage and will end up boosting the satisfaction and loyalty of workers.

Why Employers Offer Health Insurance Beyond the Requirement?

As an employer, you stand to gain a lot from offering health insurance aside from meeting legal requirements. This is why many small businesses still choose to offer healthcare options.

Here’s why many employers choose to offer coverage even if they’re not required to do so by law:

- Attract and retain high-quality employees

Usually, workers pay a lot of attention to the benefits they get when choosing between multiple offers. If you offer a comprehensive health benefits plan to your workers as a small business, it will help you recruit and retain top talent.

- Increase the productivity of your workforce

When employees have access to healthcare, they are healthier, experience fewer absences, and are more productive. This can create a more committed and focused workforce.

- Take advantage of tax incentives

Small businesses that choose to voluntarily give health insurance, employer concierge medicine, or other types of health coverage to their workers might qualify for tax credits. So, it also becomes a financially beneficial decision.

Ultimately, offering health benefits to your workers is a win-win situation for your business.

Employee Health Challenges & Solutions Beyond Basic Insurance

While basic health insurance is important, it still might not cover all the needs of your employees. There are tons of challenges you stand to face. This is where executive health programs come in to save the day with more comprehensive solutions.

Let’s talk a bit about some of the most common challenges and their solutions.

- Understanding the diverse and specific needs of your workers

General health insurance might not take chronic conditions or medical history into account when covering basic health needs.

If you choose a more personalized solution like WorldClinic, your workers will get more in-depth and tailored care than any regular healthcare practice could give.

- Costs of healthcare

As an employer, you should know that you might be paying higher fees if you are not tailoring your health benefits plans. Some brokers don’t even try to pick referrals within insurance networks, which is a net loss.

With WorldClinic, your plans will be easily tailored, and you will rest easy knowing that most of our referrals will be within the insurance network.

- Complexities with legal compliance

If you’re new to health insurance compliance, there are tons of nuances you should know about. However, if you choose the right partner who will offer only HIPAA-compliant solutions and is well-versed in healthcare compliance intricacies, you’ll be on the right track.

- Data management and technology issues

Basic health insurance lacks the solutions your workers might need during a health emergency. The solution here is to work with a provider that offers telehealth solutions and summarized EMRs that take patient data security into account.

These are only the tip of the iceberg when it comes to the benefits of executive health in the context of employer health insurance. So, if you’re looking to avoid all the challenges that come with basic health insurance and give your workers next-level healthcare, you’ve come to the right place.

Concierge Medicine – the Ideal Complement to your Health Benefits Plan

Health benefits plans can take different shapes and forms. Some include dental plans, others even have life insurance, and even gym memberships. The concierge medicine model is a great addition to your employee health benefits roster thanks to its 24/7 access, advanced diagnostics and health services, and much more.

Here at WorldClinic, we offer concierge medical services that go a step beyond basic health insurance. Our group enrollments complement health insurance and other benefits of corporates and your workforce.

We solve all the challenges mentioned above and serve as a complementary healthcare option with round-the-clock telemedicine, global healthcare access, and proactive health management.

In a nutshell, WorldClinic is the perfect addition to your traditional health benefits. We cater to your employee’s unique needs and give you a competitive edge when hiring. On top of that, WorldClinic solutions can be cost effective thanks to our utilization management principles that ensure you, the employer, only pay for the health benefits that you need.

Conclusion

As an employer, you need to understand your obligations and rights when it comes to health insurance and the ACA.

You stand to face penalties if you don’t comply with specific requirements, but you also stand to gain a lot from offering insurance options to your workers, even as a small business. So, it’s a win-win situation.

Want to attract top talent and boost the satisfaction of your employees? Offering health insurance can do the trick and give you a competitive edge as an employer in the market.

With concierge membership plans like what we provide here at WorldClinic, you can give your workers an elevated level of care, and address all their health needs with telemedicine, personalized support, and comprehensive care coordination.

If you’re ready to give your workers the best of the best when it comes to healthcare, don’t hesitate to reach out to us.

Employee Health Insurance FAQs

Can you offer benefits to some employees and not others?

The short answer is yes. As an employer, you can offer different benefits to different types of employees like full-time-part-time, etc. You can offer executive concierge medicine plans to your key men and offer other comprehensive health benefits to other workers. Nevertheless, the benefits you offer have to be given equitably to avoid discrimination.

Why don’t employers offer health insurance?

Offering health insurance can be costly and bring in a huge administrative burden. So, if a business falls below the 50-employee threshold of ACA, they are legally allowed to not offer health insurance.

Do employers have to offer health insurance to full-time employees?

Under the ACA, businesses that have 50 or more full-time workers or equivalents need to give health insurance options to a minimum of 95% of their full-time workers. However, if the company doesn’t reach the 50-worker threshold, they don’t need to offer insurance benefits.

Do I have to offer health insurance to all employees?

As an employer, you are only required to offer health insurance to full-time employees (if you have more than 50 full-time workers or FTEs). Under the ACA, you are not obligated to extend coverage to your part-time, seasonal, or temporary workers.

Do employers have to offer health insurance to part-time employees?

No, the ACA does not put an obligation on employers to offer affordable health insurance to part-time employees (those who work less than 30 hours per week)

How many employees do you have to offer health insurance?

If you are an employer with 50 or more full-time workers or FTEs, you are legally required to offer affordable health insurance options to your full-time workers. If you have fewer than 50 full-time workers, your business is exempt from this requirement of the ACA.

Do small businesses have to offer health insurance to employees?

No, unless the business has more than 50 full-time workers or FTEs. However, you can still choose to offer health insurance to your workers to retain your top talent, attract better workers, and potentially qualify for tax credits.

Do you have to take employer offered health insurance?

No, as an employer, you are not required to accept the health insurance your employer offers. You can choose to decline that coverage if you have other options like a spouse’s plan or government-provided plans like Medicaid or Medicare.