Direct Primary Care (DPC) was developed with patient care, affordability, and simplicity in mind. It is a membership medicine model that doesn’t include the complexities of insurance-based healthcare. For many patients, this is a great choice.

For employers choosing between different employee benefits plans to offer to their workers, DPC has a lot of advantages. In fact, they see a 54% reduction in emergency room claims and a 13% reduction in the total cost of claims. Yet, there are cons to it as well.

DPC is not a one-size-fits-all solution. While it has transparent pricing and personalized care, it also has limitations and higher out-of-pocket costs for specialist visits.

With patients looking for more personalized medicine options more and more, is this model the way to go?

In this blog, we’ll examine the main Direct Primary Care pros and cons to help you choose if it’s the right model for you and your organization. Let’s get started.

What is Direct Primary Care (DPC)?

Direct Primary Care is a healthcare model where patients pay a fixed monthly or annual fee to their provider for primary care services like check-ups and diagnostics.

In contrast to traditional healthcare, DPC doesn’t rely on insurance, which makes the process easier for patients and providers alike.

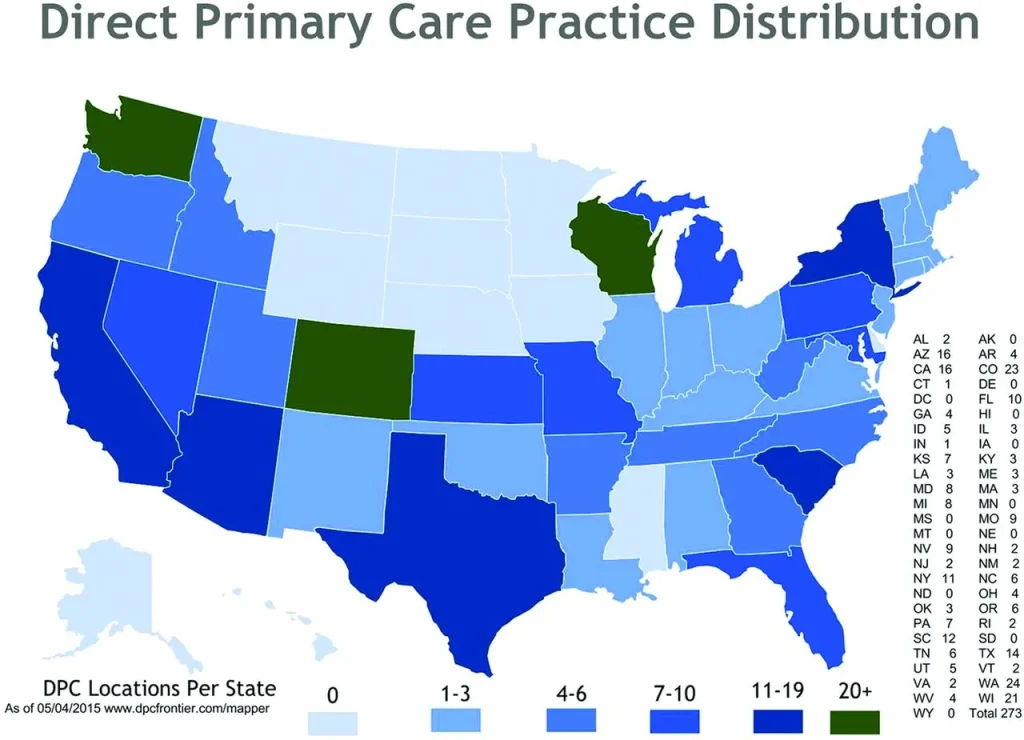

As of 2023, there were already 1600 DPC practices across the US. Slowly but surely, the popularity of this model is going up.

Services that are usually included in DPC plans include:

- Routine physicals and check-ups

- Preventive care and wellness visits

- Basic diagnostic tests

- Chronic disease management

Services that are usually excluded in DPC plans include:

- Specialist care and consultations

- Emergency room visits and hospitalizations

- Major surgeries

Overall, DPC covers the basics of primary care, but you might need supplemental insurance to cover its limitations.

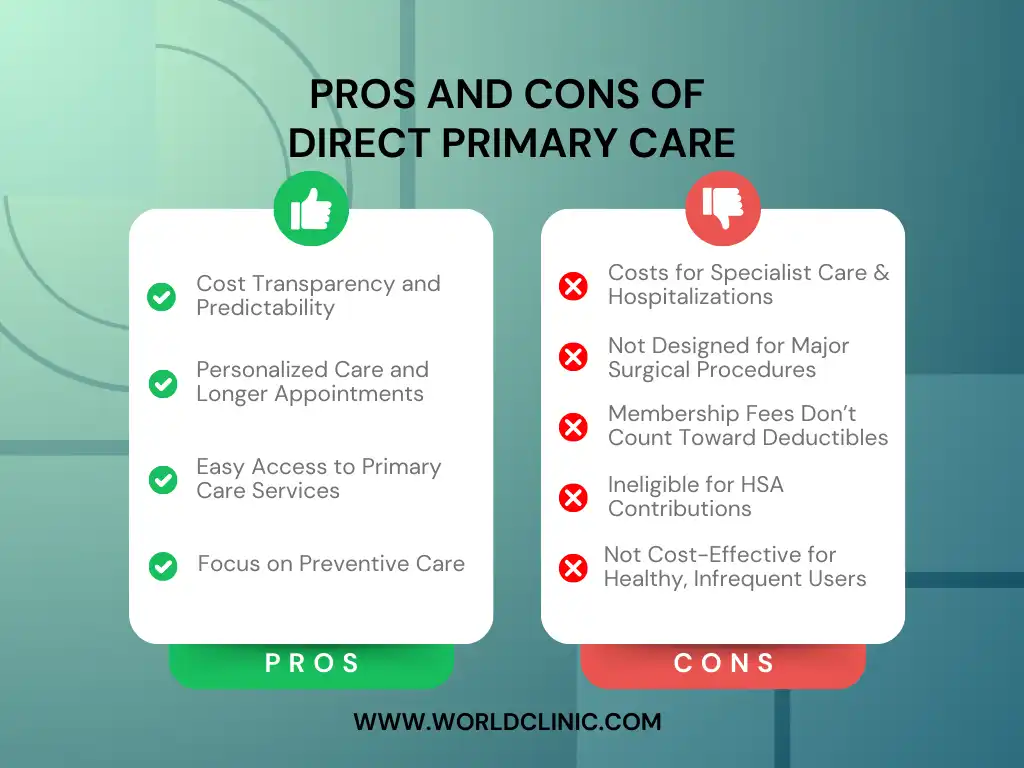

4 Pros of Direct Primary Care (DPC)

Let’s start our direct primary care pros and cons comparison with the good news. As a patient, you will feel cared for when using DPC. With longer appointments and an effort to build strong doctor-patient relationships, DPC streamlines care and prioritizes preventive care. Let’s talk about the 4 main selling points of DPC.

1. Cost Transparency and Predictability

DPC has fixed fees, meaning that patients can budget their healthcare expenses without having to worry about deductibles, co-pays, or hidden charges. Patients get transparent and predictable pricing, giving immense value to both their families and business owners managing their employee health benefits plans.

2. Personalized Care and Longer Appointments

Next up on our list of direct primary care pros and cons, let’s talk about the quality of care. With DPC, there are no insurance-related limitations. This means that you can spend more time with your doctor and help them fully understand your medical history. Ultimately, you get better diagnoses, treatment plans, and health outcomes.

Note: Tailored healthcare is also one of the biggest benefits of concierge medicine.

3. Easy Access to Primary Care Services

DPC services thrive in terms of accessibility. You can expect shorter wait times, same-day or next-day appointments, and 24/7 contact with your healthcare provider through calls, emails, or telehealth platforms.

4. Focus on Preventive Care

Similar to personalized concierge medicine, DPC puts a strong emphasis on preventive and proactive care. Instead of treating symptoms as they come up, DPC doctors look deeper into your health problems and include lifestyle counseling and routine screenings in your treatment plans.

At the end of the day, patients end up avoiding expensive treatments over the long term.

5 Cons of Direct Primary Care (DPC)

We’ve talked about the good, now let’s talk about the bad when it comes to direct primary care pros and cons. Since DPC focuses more on primary care, it lacks higher-level services in its scope, such as specialist visits or hospital stays.

To understand whether DPC is the right choice for you or your organization, let’s discuss its drawbacks further.

1. Out-of-Pocket Costs for Specialist Care and Hospitalizations

Unlike traditional health insurance plans, DPC memberships do not include coverage for hospitalizations, specialized care by medical specialists, or emergency room visits.

If you need a specialist consultation or have an emergency, you will most likely have to pay additional fees or rely on alternative insurance coverage for such services.

2. Not Designed for Major Surgical Procedures

Along with specialist care and emergencies, DPC services also don’t include major surgeries that require hospitalization. It’s safe to say that DPC is best for minor ongoing health problems rather than insurance over your health.

If surgery comes your way, you’ll have to turn to supplemental insurance, which means that you’ll be facing higher costs eventually.

3. Membership Fees Don’t Count Toward Deductibles

With traditional insurance, you, as a patient, could apply your medical fees toward health insurance deductibles. With DPC, this isn’t a possibility, which makes this option less financially attractive for those who have high-deductible plans.

Note: Not being tax deductible is also one of the few disadvantages of concierge medicine.

4. Ineligible for HSA Contributions

DPC membership fees are usually ineligible for HSA (Health Savings Account) contributions, which means you will have limited tax advantages. While DPC itself is an affordable option, you, as a patient, could be covered under a more convenient plan based on your specific needs.

5. Not Cost-Effective for Healthy, Infrequent Users

If you rarely visit the doctor or don’t have lots of healthcare needs, the recurring fees can add up very quickly to become not worth it. It can become a subscription you pay for but rarely use. This is a less practical option for you because the costs will outweigh the benefits you get.

On the other hand, if you’re suffering with a chronic illness, a DPC can be an advantageous option for ongoing care.

Weighing the Pros and Cons of Direct Primary Care

DPC offers great advantages, particularly for patients who are seeking personalized, affordable, and accessible primary care. However, it has limitations in terms of its service scope and the need for supplemental insurance, making it less fitting for patients with complex medical needs.

If you are considering DPC, ask yourself the following questions:

- Do you require regular specialist or emergency care?

- Is there a reputable DPC provider in your area?

- How do the costs compare to your current healthcare expenses?

For both patients and business owners, it’s important to weigh direct primary care pros and cons against each other. While DPC is a good option for some people, there are other healthcare models out there that can offer bigger advantages.

Comparing Direct Primary Care to Other Healthcare Models

If you’re torn between DPC and other healthcare models, let us help you make the right decision. Some of the more valuable or popular healthcare models are traditional health insurance, and a seasoned pro in premium healthcare – concierge medicine.

Traditional insurance-based healthcare vs DPC

Traditional healthcare usually provides comprehensive coverage in terms of services like emergency care, hospital stays, and specialist visits. However, you stand to face tons of long wait times, higher costs, and more “one-size-fits-all” care rather than personalized health plans.

Concierge medicine vs DPC

Concierge medicine lands on the premium side of the spectrum for healthcare models. It offers a broader scope of services than DPC, including specialist access and global medical support. While its price tag is higher, it is truly worth it for patients who care about high-quality, personalized, and comprehensive healthcare.

When comparing direct primary care to concierge medicine, you can also see similarities. For example, both of these options are membership-based models.

If you’re looking for maximum flexibility, you can choose to seamlessly integrate WorldClinic’s concierge primary care and other solutions with DPC to get the best of both worlds.

Conclusion

Direct Primary Care is a patient-centric, streamlined approach to primary care. It is undoubtedly an appealing and affordable choice for many who often visit primary care doctors for check-ups and diagnostics. However, it has its limitations.

Considering the lack of emergency care and specialist visits, the drawbacks of direct primary care might make you want to evaluate other healthcare options before committing.

To understand whether this model fits your health needs, it’s crucial to look at the direct primary care pros and cons. Weighing them against other models will help you choose your best match.

For those seeking a more comprehensive solution, consider concierge medicine – an ideal alternative that combines the personalization of DPC with broader coverage and global accessibility. Explore our membership plans or contact us to learn more about how our tailored healthcare experience can meet your medical needs.

FAQs

1. What is a criticism of direct primary care?

When looking at the pros and cons of direct primary care for the patient, one of the main criticisms is that DPC doesn’t cover specialist care, ER visits, or hospitalizations. This means that you’d have to rely on additional insurance, and the price tag might not be worth it considering that DPC fees don’t apply toward deductibles or HSAs.

2. What is the difference between primary care and direct primary care?

Primary care is an umbrella term that refers to the general medical care physicians provide for check-ups, preventive care, etc. Direct Primary Care, on the other hand, is a specific healthcare membership model where patients pay monthly or annual fees directly to their provider and bypass traditional insurance.

3. Is direct primary care tax deductible?

In most cases, DPC membership fees will not be considered tax-deductible under US tax laws. However, depending on state-specific regulations or if the fees are part of your business’s healthcare expenses, there may be some exceptions. To understand how tax deductibles work for your DPC plan, we recommend consulting with a tax professional.

4. Is direct primary care covered by HSA?

DPC fees are generally not eligible for reimbursement through HSAs (Health Savings Accounts). The IRS doesn’t classify DPC as a qualified medical expense, but efforts are being made to change this classification.

5. Is direct primary care the same as concierge medicine?

Direct Primary Care and concierge medicine have many similarities, but they differ in their scope and cost. For example, both DPC and concierge medical services work on a membership basis. However, concierge care includes global, 24/7 physician access, a broader service base, and comes at a higher price point.

6. How much does direct primary care cost?

Pricing for DPC varies from $40 to $200 per month per patient. The cost will depend on the provider you choose, and the services included. Usually, this fee covers primary care visits, basic diagnostics like blood work, and preventive care options, making it a cost-effective option for your routine healthcare needs.