Today’s job market is competitive, to say the least. Companies are offering comprehensive employee benefits as a strategy to attract and retain top talent, and it is working.

Employee health benefits are more important than you think. In fact, 70% of employees in the US would consider switching their jobs if offered better benefits.

From better mental health support and flexible work schedules to wellness programs and executive physicals, these sorts of benefits keep on growing and developing. Many companies are re-evaluating their benefits packages, including options like family concierge medicine to better address diverse employee needs.

As of March 2024, employee health benefits were available to 72% of private sector workers and 89% of state and local government workers.

But there’s a difference between having benefits and having good benefits. This is where tailored employee health benefit plans come in to give your company a competitive edge.

Here at WorldClinic, we know how important it is to give your employees the best possible health benefits based on their needs. With our concierge executive health programs, the healthcare world will be their oyster.

In this blog, we’ll tell you all about employee health benefits, how to build customized plans, strategies you can use to control your employee health benefits costs, and much more. Let’s get started.

Key Takeaways

- Tailored health benefits plans are key to attracting and retaining top talent.

- Employee health benefits go beyond simple medical insurance and cover other things like mental health support, sick leave, life insurance, etc.

- Costs for custom health benefit packages can be high, so using utilization management and other cost-cutting techniques can help.

- Compliance with health benefit regulations is non-negotiable. Pay attention to requirements like ACA, COBRA, HIPAA, and ERISA to avoid penalties and fines.

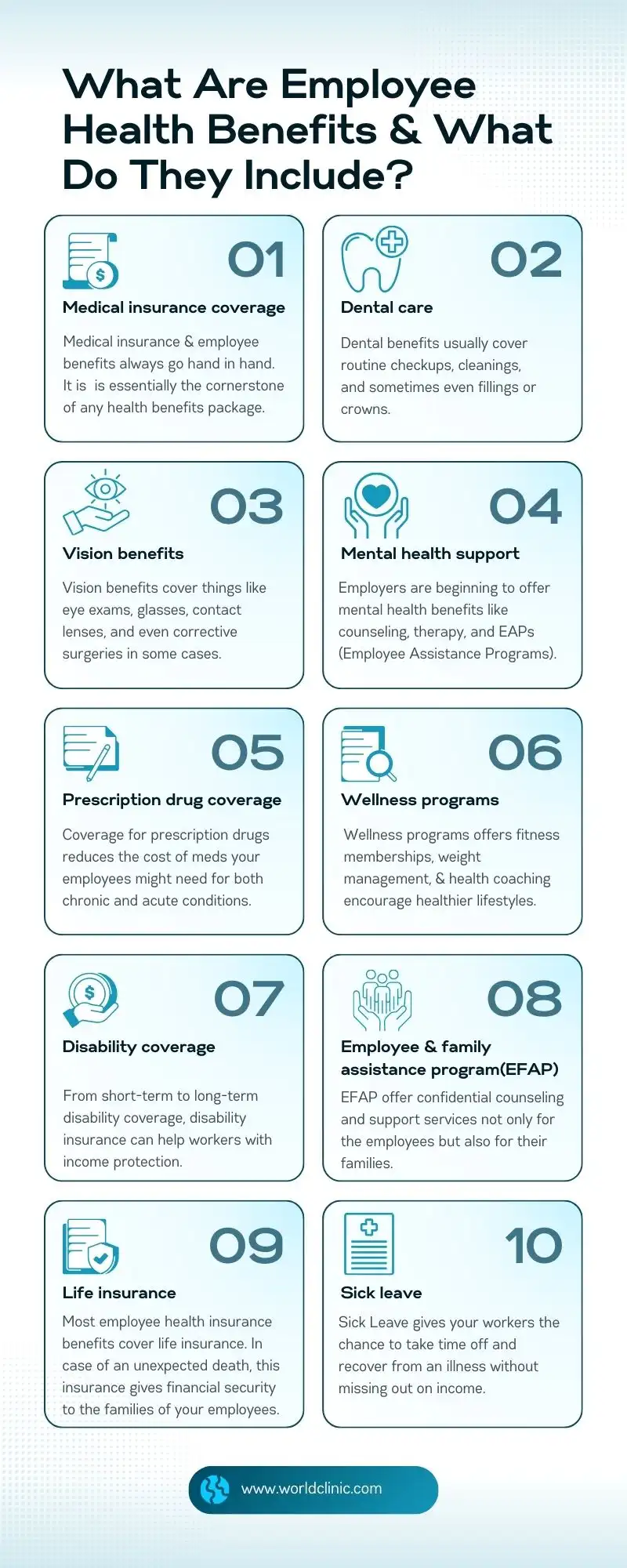

What Are Employee Health Benefits & What Do They Include?

Employee health benefits give workers access to different healthcare services, making sure they can receive the necessary medical support to stay healthy both mentally and physically.

These sorts of benefits are not only important for the health of your employees and key men but also for fostering a highly supportive culture at work.

While these plans usually take different shapes and forms, let’s talk about the 8 key components of employee health benefits:

1. Medical insurance coverage

Health insurance and employee benefits always go hand in hand. Medical insurance is essentially the cornerstone of any health benefits package, usually covering important services like:

- Doctor visits

- Hospital stays

- Preventive care such as annual physicals and immunizations

This is the “bare minimum” sort of coverage that makes sure employees can get the necessary healthcare they want without high costs.

2. Dental care

Not all employee health benefits include dental coverage. In fact, only 43% of private industry workers have access to dental benefits. Nevertheless, dental benefits usually cover routine checkups, cleanings, and sometimes even fillings or crowns.

3. Vision benefits

Vision benefits are even rarer than dental coverage. If employee health benefit plans include vision benefits, they cover things like eye exams, glasses, contact lenses, and even corrective surgeries in some cases.

4. Mental health support

As mental health becomes more and more prominent, employers are starting to offer employee benefits for mental health services such as:

- Counseling

- Therapy sessions

- EAPs (Employee Assistance Programs)

All of this aims to help workers deal with stress, anxiety, and other concerns. It’s no surprise that employee mental health benefits are becoming increasingly expected by current and potential employees.

5. Prescription drug coverage

Coverage for prescription drugs reduces the cost of meds your employees might need for both chronic and acute conditions. Essentially, minimizes out-of-pocket expenses and helps your workers stick to their treatment plans.

6. Wellness programs

Another component of employee health benefits is wellness programs. They go beyond basic medical needs and cover well-being as a whole.

By offering fitness memberships, weight management resources, and even health coaching, companies can encourage their workers to live healthier lifestyles.

7. Disability coverage

From short-term to long-term disability coverage, disability insurance can help workers with income protection. If an employee can’t work because of an illness or injury, these benefits give them financial stability until they can recover and return to work.

8. Employee and family assistance program

Another form of employee health care benefits is an Employee and Family Assistance Program (EFAP). They offer confidential counseling and support services not only for the employees but also for their families.

From managing work-related stress to family changes, these programs help employees and their loved ones with personal and professional hurdles.

9. Life insurance

Most employee health insurance benefits also cover life insurance. In case of an unexpected death, this insurance gives financial security to the families of your employees. For employers, understanding whether employer are required to offer health insurance and what additional benefits like life insurance entail can ensure that they provide comprehensive support to their employees. Nevertheless, Life insurance cover things like:

- Funeral expenses

- Outstanding debts

- Costs of raising children

- And more

10. Sick leave

Last but not least, let’s talk about how employee health benefit plans cover sick leave. It gives your workers the chance to take time off and recover from an illness without missing out on income. It also decreases the risk of workplace contagion and supports a healthier work environment.

Having a diverse range of coverage for your employee health benefits plans will help you make your employees feel valued and empower them to care for their health.

Customizing Plans: Building an Employee Health Benefits Plan

Having a one-size-fits-all health benefits plan for your employees might not be an attractive factor for potential new hires. This is where customized plans come in to save the day and give you a competitive edge when hiring.

Offering the best employee health benefits is a great executive health risk management strategy.

With a tailored health benefits plan, you can make sure to meet the needs of your specific workforce. You can do this by taking the demographics of your workforce into account when you build an employee health benefits plan.

So, consider the following when customizing your employee health benefit plans:

Age, gender, and family composition

Younger employees might prefer mental health coverage with lower premiums while older employees might care more about comprehensive family plans or chronic care management.

Consider the age, gender, and family composition of your employees to be able to offer them the most valuable benefits packages.

Income levels

Your employees’ ability to cover medical costs highly depends on their income levels.

For example, for higher-income employees, you can offer tax advantages with health savings accounts (HSAs) or flexible spending accounts (FSAs).

On the other hand, lower-income employees can benefit more from low-deductible plans with predictable out-of-pocket costs.

Health history and preference

Another critical factor you need to consider is the health history of your employees. Do any of your workers have chronic conditions? This needs to be taken into account when designing their plans.

Employee health screening methods such as, biometric screening can uncover the health history of your employees. These existing conditions might benefit more from preventive care options and wellness programs that focus more on ongoing health management.

Part-time and remote workers

Last but not least, your health benefits should be adaptable to part-time or remote workers. This can include things like offering prorated part-time employee health benefits and telemedicine services for your remote workers.

Flexibility is of ultimate importance when it comes to meeting the needs of your employees in the best possible way. Whether it’s the ability to switch between different health plans or access to HSAs or FSAs, this customization will help you boost satisfaction and retention.

How Much Do Health Benefits Cost Per Employee?

While the benefits of executive health program customization are too many to count, they also come with a price tag.

As a company, it is natural for you to want to find a balance between the best employee health benefits and an appropriate budget.

In 2023, the average cost of benefits per employee reached $15,797. Unfortunately, this figure is estimated to rise around 5.8% in 2025, accounting for cost-saving strategies as well.

On the other hand, there are basic concierge executive health plans that usually cost upwards of $10,000.

The factors that affect these costs usually include:

- Your company’s size

- Type of plan you offer

- Employee demographics

As an employer, you can control some of the costs if you offer a mix of high-deductible and low-deductible plans. This way, you’ll give your employees the flexibility to choose their plan based on their health needs and financial situation.

Another strategy for reducing your benefits coverage expenses is to integrate telemedicine services. If you’re looking to reduce the number of claims you get, you can offer wellness programs that promote healthy habits.

Finally, you can encourage your employees to take part in HSAs and FSAs to make their spending more tax-efficient. Additionally, you can use utilization management tactics to cut down on costs.

Legal Considerations and Compliance for Employee Health Benefits

While offering health benefits to your employees can help you support the well-being of your workers, it can also help you comply with legal requirements.

There are some regulations you should know about if you want to avoid penalties and make sure you give fair treatment to your employees.

- ACA Compliance

According to the Affordable Care Act, businesses that have 50 or more workers need to offer health insurance that meets specific standards.

- COBRA

The Consolidated Omnibus Budget Reconciliation Act (COBRA) mandates that employers need to give health benefits to their employees who leave the company under some specific conditions so that they have continuity of coverage during transitions.

If you don’t comply, you stand to face fines and other penalties.

- HIPAA

According to the Health Insurance Portability and Accountability Act (HIPAA), the health information of your employees must be protected, especially if it contains sensitive mental health and medical records.

- ERISA

The Employee Retirement Income Security Act (ERISA) governs employer-sponsored health benefits plans and requires that benefits must be managed fairly and transparently.

- Tax Implications

Some benefits you offer to your workers are taxable and have an impact on your company’s tax situation. As an employer, you need to understand how to offer health benefits to comply with specific tax regulations.

Usually, working with a concierge executive health provider like WorldClinic can help be the guiding hand that’ll make sure you comply with all regulations.

Why Employers Should Invest in Employee Health Benefits

Offering employee health benefits has tons of benefits. From helping you manage key man risk to making your workers feel safe and supported, there’s a lot you can gain. Additionally, there’s a direct link between offering robust health benefits and retaining talent.

Studies show that companies with comprehensive health benefits packages have lower turnover rates. On top of all that, having tailored benefits can be a significant differentiator in how people evaluate job offers.

So, let’s talk about why you, as an employer, should invest in competitive employee health benefits packages.

1. Recruit top candidates

Great health benefits are a strong selling point for potential hires. 57% of workers in the US have taken or might take a new job if they offer better family reproductive benefits.

If your company offers robust benefits or even executive concierge medicine packages, you’ll have an easier time attracting top talent.

2. Retain key employees

If you’re offering health benefits for employee retention, you’re on the right track. Employees will be more likely to stay with your company if you invest in their health and well-being.

This way, you can reduce turnover and avoid the costs of hiring and training new staff.

3. Tax advantages

There are huge benefits to be gained in accounting for employee health benefits. If you offer such benefits, you can get tax breaks and deductions. At the end of the day, offering employee health benefits plans is good for business.

4. Lower absenteeism rates

Health benefits keep your employees healthy and productive. They reduce the chances of them missing work due to an illness, so you can reduce absences if you invest in your employers’ duty of care.

5. Increase focus and productivity

Healthy employees are productive employees. By giving your workers health benefits, you will make them feel valued and supported, which, in turn, will lead to greater focus, morale, and productivity.

Tailoring Executive Health Plans for Employers: Challenges & Solutions

Customizing your executive health plans is easier said than done. There will be challenges along the way but there are solutions to these problems as well.

For example, it can be tough to:

- Find the right health benefits or care provider

- Control your costs

- Make sure your remote and traveling employees have access to care

- Take care of risk management and compliance

- Keep up with comprehensiveness and continuity of care

To fight these issues, one of the best things you can do is invest in concierge medical services. The executive health plans we offer here at WorldClinic can help by tailoring your plans to each executive’s needs.

Our membership plans include facilitated executive physicals, global and 24/7 care coordination, preventive and urgent care for busy individuals, and much more. In a nutshell, they benefit both your employees and you.

Conclusion

To wrap it all up, let us reiterate the value and importance of employee health benefits plans to the productivity and wellness of your business. They can help you attract and retain top talent in a competitive market.

Once you understand the different components, costs, and legal considerations of health benefits, you can start customizing your benefits plans to meet the specific needs of your workers.

With WorldClinic’s personalized health solutions, you can give your executives and employees the accessible, comprehensive, and compliant care they deserve.

If you’re ready to offer better healthcare to your workers, we recommend you explore our membership plans.

Reach out to us If you want to learn more about how we can offer support in building your employee health benefits strategy.

Employee Health Benefits FAQs

What health benefits are typically available to employees?

Employee health benefits usually include medical insurance, dental coverage, mental health support, life insurance, wellness programs, disability insurance, and more. Some companies also offer vision coverage, prescription drug coverage, and Employee Assistance Programs (EAPs).

What are the top 5 types of employee benefits?

The top 5 types of employee benefits include:

1. Medical insurance

2. PTO (paid time off)

3. Retirement savings plans like a 401k

4. Mental health support

5. Flexible work schedules

All of these benefits play a huge role in promoting a good work-life balance, financial stability, and the health of your employees.

Why are healthcare benefits important to employees?

Healthcare benefits are important to employees because they can help reduce the financial burdens of medical costs and give them access to healthcare services in general. They also make employees feel valued and supported, which improves their productivity, job satisfaction, and more.

Do all employees get the same health benefits?

Not all employees get the same health benefits. Benefits can vary depending on the worker’s employment status (full-time, part-time, remote), job role, seniority, and other company policies.

What benefits do employees value most?

Usually, employees pay the most attention to health insurance, retirement savings plans, flexibility in schedules, PTO, and mental health support. These benefits give them a sense of security and support.

Are employee health benefits taxable?

Usually, employee health benefits are not taxable. However, there are some benefits like life insurance or wellness incentives that can be considered taxable if they go over a specific coverage limit. It’s important to consult with a tax advisor to understand your specific tax concerns.

Is health insurance an employee benefit?

Yes, health insurance is usually one of the most common and valuable employee benefits. It covers things like doctor visits, hospital care, and preventive health services, reducing out-of-pocket expenses for employees.