This post was co-authored with Dr. Daniel Carlin, MD, Founder and CEO or WorldClinic.

You’re likely familiar with the personalized healthcare model offered by concierge medicine and its evolving trends, but you might be wondering: how does concierge medicine work with insurance?

Most concierge practices do not accept health insurance, but some work with health insurance providers symbiotically to enhance patient care.

Yet, such a partnership can be complex, and navigating it requires a clear understanding of several critical aspects.

Let’s explore how concierge medicine providers collaborate with insurance companies, the pros and cons of concierge medicine when combined with traditional insurance and some insider tips.

Does Health Insurance Cover Concierge Medicine?

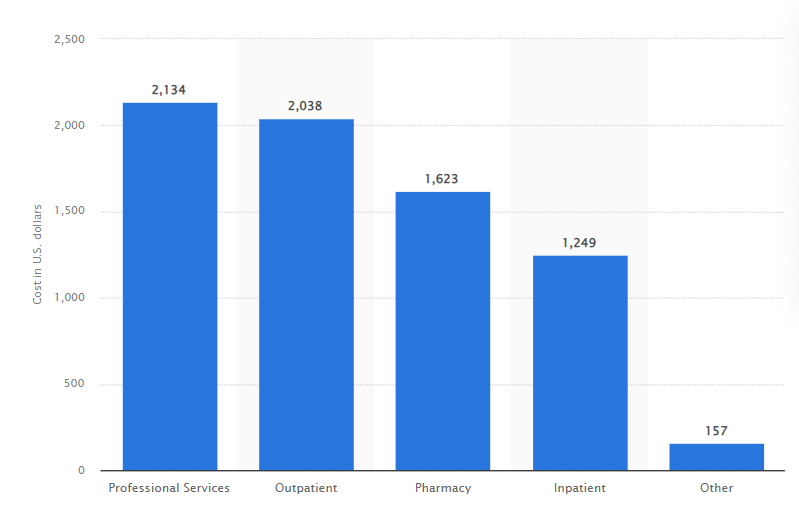

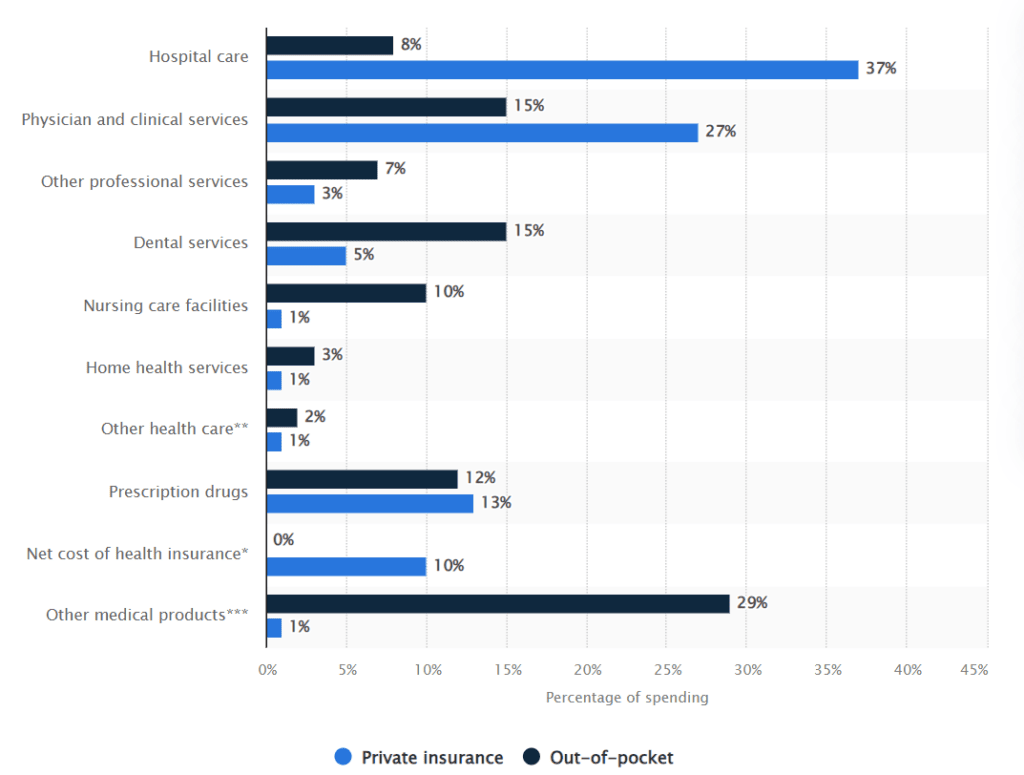

Typically, concierge medicine involves two types of fees: medical fees for services like procedures and prescriptions and membership fees for enhanced access and personalized care. While your health insurance may cover the medical fees as it would in a traditional healthcare setting, the membership fees are generally not covered.

Concierge medicine membership costs typically range from $1,200 to $50,000 annually, depending on the level of personalized care provided.

The downside?

These fees are out-of-pocket expenses that are not eligible for insurance coverage.

However, for those with Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), it’s worth checking if your plan considers these fees permissible.

How Does Concierge Medicine Work with Insurance?

While it’s true that most concierge practices do not directly involve insurance in covering membership fees, there are scenarios where the benefits of health insurance can complement the bespoke services and benefits offered by concierge medical practices.

Let’s explore the different insurance options and the billing process around them.

Medical Insurance Models and Options

There are various types of health plans, including:

- Medicare

- Medicaid

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Health Maintenance Organization (HMO)

- High Deductible Health Plan (HDHP)

- Point of Service (POS)

- Catastrophic Health Insurance

Some of these (such as HMOs, PPOs, and high deductible health plans) may influence exactly how benefits apply. For instance, PPOs offer more flexibility in choosing providers without needing referrals, which is conducive to concierge settings. You can explore the differences between POS and PPO to better understand how these plans fit various healthcare models.

This symbiotic partnership allows you to enjoy the personalized care of a concierge doctor while utilizing your insurance for significant healthcare expenses.

Process of Concierge Medicine Billing

In concierge practices that accept health insurance, standard procedures like labs, medications, and concierge specialist visits are billed to your insurance provider, like a traditional primary care practice. Patients are often responsible for co-pays and any deductibles their plan requires.

Upon enrolling in a concierge medicine practice, patients usually submit their insurance details so the practice can efficiently manage claims for these covered medical services. For non-covered services, primarily the concierge membership fees, patients handle these costs out-of-pocket. This membership typically includes preventive care, extended access to doctors, and other personalized services.

For services that fall outside the concierge plan but require medical attention, such as emergency room visits or specialized surgeries, the practice will coordinate with your insurance for billing.

Pros and Cons of Combining Concierge Medicine and Insurance

To understand whether combining concierge medicine with traditional health insurance is a good option for you, consider the following pros and cons:

Pros

The integration of concierge medicine with traditional health insurance offers several compelling benefits:

- Better patient care: Concierge medicine’s subscription-based medical care structure provides physicians with stable revenue and removes the uncertainties associated with fee-for-service billing. This stability often results in enhanced focus on patient care rather than on the volume of services provided.

- Deeper doctor-patient connections: Extended appointments allow in-depth health discussions, fostering stronger and more personalized doctor-patient relationships.

- Dual coverage flexibility: Patients enjoy comprehensive coverage—routine medical needs are covered by insurance, while concierge services offer tailored care and preventive wellness.

- Proactive health management: Beyond concierge emergency medicine, the concierge model’s emphasis on preventive care helps in the early detection of health issues, complemented by insurance coverage for necessary treatments.

Cons

While integrating concierge medicine with traditional health insurance offers numerous benefits, there are also some potential drawbacks to consider:

- Limited physician availability: Availability and patient-to-physician ratios differ in concierge medicine vs direct primary care. Concierge practices typically serve a much smaller patient base—often between 450 to 600 patients compared to 2,500 in traditional primary care. This can result in physician shortages, particularly in primary care specialties.

- Reduced accessibility for some populations: The membership model of concierge medicine may be less accessible for low-income individuals or those living in rural areas where such services are less common.

- Potential for bias: With the ability to choose their patient load, concierge physicians might inadvertently allow bias to influence whom they accept into their practice, potentially affecting the diversity and equity of care delivery.

- Impact on the healthcare system: As concierge medicine becomes more popular, it could shift the dynamics of the healthcare system, potentially drawing resources away from traditional care models.

- Administrative complexities: Not all concierge practices offer seamless integration with insurance providers, leading to potential administrative complexities for patients. This can include difficulties in billing, insurance claims, and coordination of benefits, which can detract from the smooth and personalized care experience.

Tips for Concierge Medicine Members with Insurance

Navigating the complexities of combining concierge medicine with insurance requires a thoughtful approach to choosing and utilizing a concierge medical provider. Here are some essential tips to ensure that you benefit maximally from both services without undue hassle and expense.

Carefully Consider the Costs

Before committing to a concierge medicine practice, it’s crucial to assess the costs involved. While the membership fees are typically not covered by insurance, the comprehensive, personalized care provided often justifies the investment.

Evaluate the potential out-of-pocket expenses against the benefits of longer appointments, more direct access to your physician, and a less hurried healthcare experience.

Review the Service Offering

Select a concierge practice that not only offers services accessible anytime and anywhere but also clearly facilitates the coordination between healthcare and insurance providers. This can significantly reduce administrative burdens.

Also, ensure the practice offers services that align with your health priorities and logistical needs, enhancing accessibility for you, your family, or your workforce.

Favor Personalized Care with Qualified Physicians

Choosing a concierge doctor or practice involves more than just evaluating costs and services – it also means selecting a provider with whom you can build a lasting, trusting relationship.

Interview potential physicians to understand their approach to care, including their views on preventive medicine, patient education, and their handling of chronic conditions. Ensure the doctor is board-certified and the practice’s philosophy aligns with your health values and needs.

Inquire About Insurance Integration

When discussing potential concierge services, ask specific questions about insurance coverage:

- Which insurance plans do you accept? Knowing whether your provider is covered can maximize the benefits you receive.

- How does insurance billing work in your practice? Understand which services are billable to insurance and how reimbursements are handled.

- Do you assist with insurance reimbursement? Practices that offer help with insurance can ease the process, ensuring you are reimbursed where applicable.

- Can you help verify my insurance benefits? This is crucial for understanding what your insurance covers, including co-pays and deductibles.

Discover the WorldClinic Difference in Concierge Medicine

At WorldClinic, we understand that choosing the right concierge medical service is crucial to ensuring not just quality medical care but also peace of mind.

Our unique approach to concierge medicine sets us apart, emphasizing seamless coordination with insurance providers and delivering a healthcare experience that goes beyond traditional models.

Excellence in Healthcare Delivery

WorldClinic is proud to hold URAC accreditation, a testament to our commitment to high-quality care standards. Our team of board-certified concierge physicians brings a wealth of experience and dedication, ensuring that each patient receives the utmost attention and personalized care.

Added Value through Innovative Coordination

We excel in working within your insurance network to facilitate referrals and coordinate necessary medical procedures. Our proactive consultations and treatments are designed to prevent health issues before they escalate, ensuring a healthier, more fulfilling life.

Personalized Care and Accessibility

Personalized care at WorldClinic is enhanced by our Prescription Medical Kits, which provide members with essential healthcare resources at their fingertips, wherever they may be. Coupled with our comprehensive telemedicine services, members enjoy unparalleled access to healthcare anytime, anywhere.

Experience the WorldClinic Advantage

Join WorldClinic and experience a superior form of healthcare that aligns with your lifestyle and exceeds your expectations. Whether you are looking for individual, family, or executive membership plans, our concierge services are designed to cater to your unique needs without the usual constraints of traditional insurance-based care.

Discover how we can support your health and well-being through our exceptional concierge medicine services.

Concierge Medical Insurance FAQs

Discover the answers to some commonly asked questions on concierge medicine and insurance.

Does insurance cover concierge medicine?

Insurance typically covers medical services like diagnostics, medications, and treatments provided in concierge medicine, like traditional healthcare models. However, membership fees, which cover enhanced access and personalized care, are usually not covered by insurance.

Do concierge doctors take insurance?

Yes, many concierge doctors take insurance for medical services that fall under standard health insurance coverage. This can include lab tests, prescriptions, and other procedural costs.

What does a non-participation partner mean in concierge medical insurance?

A non-participation partner in concierge medical insurance refers to a concierge practice that does not enter into contractual agreements with insurance providers. This means they do not directly bill insurance for services rendered, though they may assist patients in submitting claims for reimbursement.

Does concierge medicine insurance affect premiums?

Joining a concierge medicine practice should not directly affect your insurance premiums, as these are determined by your insurance provider based on various factors, including coverage terms and healthcare usage, not by the concierge service fees.

Can I use my HSA or FSA to pay for concierge medicine?

You can often use HSAs or FSAs to pay for qualifying medical expenses within concierge practices, such as treatments and diagnostics. However, membership fees are typically not eligible expenses unless explicitly stated by your HSA or FSA guidelines.

What insurance plans are widely accepted by concierge medical practices?

Concierge medical practices commonly accept a broad range of insurance plans, including major carriers that offer PPO and HMO products. The acceptance of insurance can vary significantly by practice, so it is advisable to confirm with the specific concierge service provider.

How do I choose a concierge medical provider that works with my insurance?

To choose a concierge provider that works well with your insurance, start by verifying that the practice accepts your insurance plan and understands its coverage complexities.

Additionally, assess how the practice handles insurance billing and reimbursement. A good provider should offer transparent communication about what is covered by insurance and what costs will be out-of-pocket.